When evaluating brokers in 2025, the big question remains: Is Gracex the right broker for you? With dozens of platforms vying for attention, Gracex positions itself as a modern, client-first alternative. But how does that claim hold up in practice?

Award-Winning Support and Explosive Growth

In 2024, Gracex was named The Fastest Growing Broker by the World Financial Award and earned The Best Customer Support recognition from the Forex Brokers Association. These accolades aren’t just banners — they reflect real-world momentum and prioritization of client satisfaction. But is that enough for your trading goals?

Let’s break it down across key criteria.

Trading Platform: The MT5 Suite for All Devices

Gracex runs exclusively on MetaTrader 5 — available as a WebTrader, desktop version, and mobile apps for Android and iOS. This gives traders broad access without installation requirements. WebTrader is particularly useful for those who prefer browser-based trading with full functionality, including advanced charting, technical indicators, and algorithmic trading.

MetaTrader 5 at Gracex supports trading robots, analytics tools, and deep automation options, making it equally suitable for beginners and pros.

So when wondering if Gracex is the right broker, platform versatility is clearly a strong point.

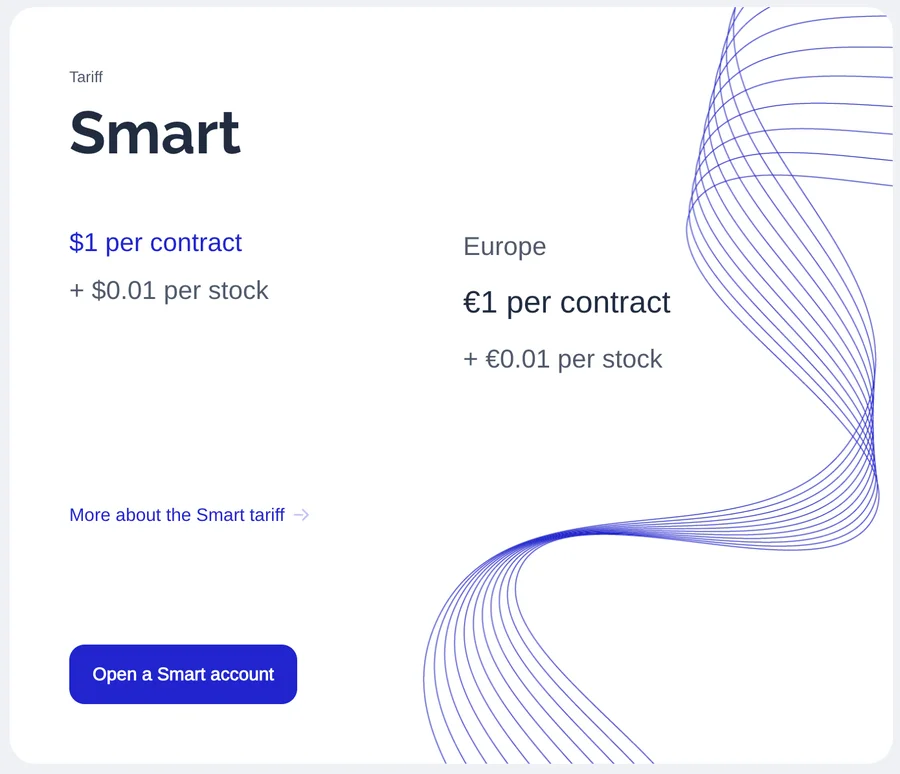

Account Types: Something for Every Level

- FREE — No commissions, up to $500 capital, perfect for testing strategies without pressure.

- ZERO — $100 monthly fee but zero spreads and no extra trading costs. Best for high-volume, tight-margin strategies.

- FIX — Fixed spreads starting from 3 points, for traders who want predictable cost structures.

- CENT — Pay-per-lot model starting at $10, ideal for micro-lot testing and strategy development.

Each account includes access to all platforms, educational content, and analytics. The commission models differ, which gives traders the ability to pick the setup that aligns with their strategy.

From this angle, the Gracex reviews suggest the broker is flexible enough to meet different trader needs.

Assets and Market Access

Gracex gives access to a wide basket of instruments:

- Forex (majors and exotic pairs)

- Indices (US, European, Asian)

- Precious metals and energy commodities

- Cryptocurrencies

- Regional CFDs: Asia, Europe, US, Russia

This diversity ensures that traders can build balanced portfolios or focus on regional strategies. All instruments are available through one login — no need to juggle multiple accounts or platforms.

If asset range matters to you, Gracex covers more than most brokers in its class — a major check in favor of being “the right broker.”

Extra Features and Services

Gracex isn’t just a trading terminal. It includes a variety of helpful tools:

- Copy trading and social trading modules for automated replication of successful traders.

- PAMM account infrastructure for investors and managers alike.

- Educational material for traders of all levels, with automation-focused courses.

- Regular analytics updates for market insights and strategic planning.

Especially useful for part-time traders, these features reduce the learning curve and expand control options.

This reinforces the idea behind our title — Gracex might just be the right platform for those seeking more than manual trading.

Regulatory Standing and Legal Transparency

Gracex is regulated by the Union of Comoros (Anjouan), operating under license number L15817/GL. Client funds are held in segregated accounts, and full KYC/AML compliance is enforced. While Anjouan is considered an offshore jurisdiction, the transparent setup and strict adherence to international finance protocols mitigate risk to a large degree.

Gracex’s regulatory status may not match tier-1 brokers, but it’s well within acceptable bounds for global traders.

Trading Conditions in Practice

One of Gracex’s standout advantages lies in its execution model. It offers:

- Spreads from 0.00 pips

- 0% commission on trades (depending on account type)

- No swaps on overnight positions

- Pure STP execution with no dealing desk — meaning no conflict of interest

In performance tests, execution speeds remained consistent even during high volatility events. That’s a good signal for scalpers and day traders.

So, based on trading conditions, the Gracex reviews favor a “yes” to the title question — for active traders, it performs well.

Reputation and User Reviews

Feedback from traders generally highlights:

- Fast execution and stable platform (frequently praised)

- Responsive, multilingual customer support

- Learning tools and social trading

Criticism is mostly centered on the offshore regulation and the $100 monthly fee for the ZERO account, which some users consider steep without heavy trading volume. Nonetheless, most reviews note the pricing model is transparent and matches what’s promised.

In light of actual client feedback, the Gracex reviews consistently answer the core title question with nuance — “It depends on your goals, but the offering is strong.”

Conclusion: So, Is Gracex the Right Broker for You?

Final verdict: Yes, if you prioritize a feature-rich platform, low trading costs, automation, and broad market access. No, if you require top-tier licensing or prefer more traditional broker setups.

Before you decide, run through this quick checklist:

- Do you need STP execution with no dealing desk?

- Do you value mobile and browser-based trading with MT5?

- Are copy trading or PAMM tools part of your strategy?

- Does the account model (FREE/ZERO/FIX/CENT) suit your capital and style?

Gracex is not for everyone — but for many traders, it’s a practical, cost-effective, and future-ready solution.