“Gracex Reviews – A Transparent Look at the Platform” — this title promises clarity in an industry often clouded by marketing jargon. But how well does Gracex (gracexfx.com) live up to that expectation? This article walks through every essential aspect: platform stability, fee structure, user tools, and regulatory standing — combining facts, examples, and user sentiment for a well-rounded perspective.

Is Gracex Really Redefining the Trading Experience?

Gracex positions itself as a modern broker breaking away from rigid legacy systems. Its mission is built around simplicity, automation, and accessibility for traders of all levels. Whether you’re trading on your phone during lunch breaks or managing a diversified CFD portfolio via desktop, Gracex aims to keep tools responsive and conditions fair.

This promise is underpinned by the MetaTrader 5 platform — accessible via WebTrader, desktop, and mobile apps (iOS/Android). MT5 is a trusted standard that supports algorithmic trading, advanced charting, and multi-threaded execution. For many users, Gracex combines this core tech with a cleaner interface and smoother onboarding than traditional brokers.

And so, the platform reflects the title: Gracex offers a transparent, intuitive interface that supports both beginners and pros.

What Can You Trade at Gracex?

Asset availability is broad and segmented. You get:

- Major, minor, and exotic Forex pairs

- Commodities: gold, silver, crude oil

- Indices across US, Europe, and Asia

- Cryptocurrencies: BTC, ETH, and altcoins

- Regional CFDs tailored by continent and demand

This structure supports thematic and regional strategies — e.g., a trader might focus on LATAM indices and local currencies without leaving the platform. That level of flexibility is rarely this accessible.

In line with the title, Gracex delivers visibility and access across global markets.

Licensing and Safety — Is Gracex Regulated?

Yes — Gracex is supervised by the Union of Comoros (Anjouan), with license number L15817/GL. This jurisdiction is known for cost-effective licensing frameworks that still enforce essential financial safeguards such as:

- Segregated client accounts

- KYC/AML compliance

- Transparent order execution audits

While it’s not a Tier 1 regulator, the presence of licensing plus no dealing desk (STP-only model) ensures a low-conflict environment — all trades are routed directly to liquidity providers.

Gracex Reviews show that traders appreciate the mix of operational freedom and safety structure.

Account Types: Who Is Each Option For?

- FREE: For new traders; zero commissions, up to $500 balance, basic access to all assets.

- ZERO: For high-frequency traders; $100/month subscription removes all trading fees.

- FIX: For strategy testers; fixed spreads from 3 points help plan entry-exit timing.

- CENT: For micro-deposit users; from $10 per lot, ideal for practice or automation.

These tiers allow tailored onboarding — rather than forcing everyone into the same funnel, Gracex builds modular entry paths.

Again, this layered structure supports the article’s title: users can choose transparency and scale at their pace.

Fees, Spreads, and Execution: How Competitive?

Gracex’s key trading conditions include:

- Spreads from 0.00 pips

- 0% commission (with some account types)

- No swaps — rare among competitors

- Pure STP execution — no dealing desk or requotes

Compared to larger brokers, these metrics place Gracex in a lean, cost-effective category. It suits scalpers, algo traders, and those who can’t tolerate markup or slippage.

These frictionless metrics back the “transparent look” claim of the title.

Extensions That Save Time and Boost Engagement

One of Gracex’s underrated strengths is its ecosystem of automated participation tools:

- Copy Trading: Mirror trades from selected professionals

- Social Trading: Follow market trends and crowd sentiment

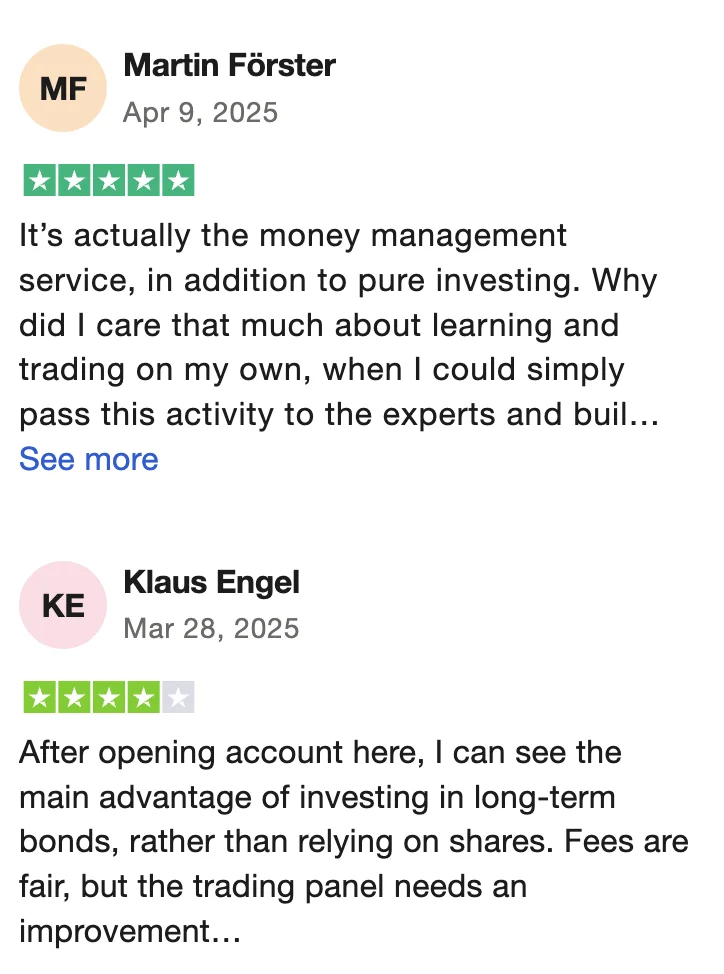

- PAMM: Allocate capital to money managers and track their performance

- Bonus Offers: Welcome packages and referral incentives

- Education & Analytics: Tiered by experience and strategy

These systems are ideal for busy users who want market exposure without constant monitoring.

In that sense, Gracex reviews echo the platform’s inclusive philosophy — automation makes pro-level trading accessible.

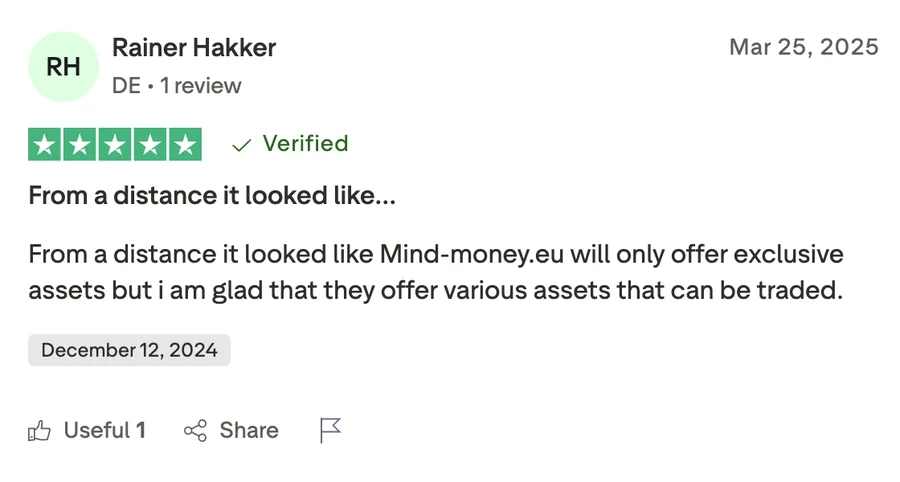

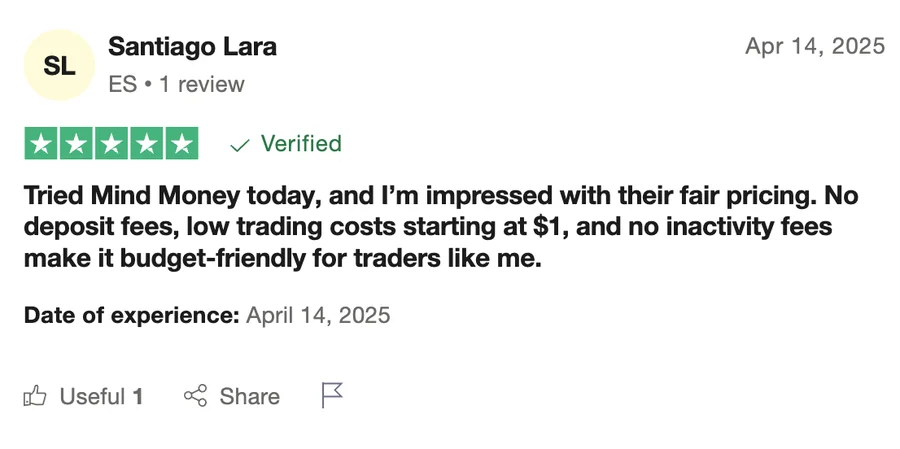

Reputation Breakdown: What Do Traders Actually Say?

Online reviews (from Trustpilot, Reddit, and trading forums) highlight a few recurring themes:

- Positive: fast onboarding, clean MT5 performance, responsive support, no fee traps

- Neutral: not regulated by Tier-1 agencies, but not misleading about it either

- Negative: some delays in crypto withdrawals during high volatility (reported mid‑2024)

The awards received — The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association) — reflect the broker’s recent user growth and strong retention across regions.

It adds credibility to the title: Gracex really is gaining trust and transparency traction in the field.

Final Verdict — Is Gracex Worth It?

So, is it true that Gracex offers a transparent, modern trading environment? Yes — for most retail and semi-pro users, Gracex delivers on its promise. It combines a powerful MT5 setup with no-hidden-fees pricing, regulatory guardrails, and scalable tools for both passive and active traders.

Checklist: What to Do Next If the Title Resonated with You

- ✅ Choose your account type based on capital and style

- ✅ Test platform stability via the FREE account (no deposits needed)

- ✅ Join a Copy or Social Trading pool to ease your entry

- ✅ Read their education/analytics for practical strategy insights

- ✅ Review license details (L15817/GL) and confirm your local eligibility

Gracex Reviews make one thing clear: transparency, when backed by tech and user tools, can redefine what it means to trade in 2025.