What really sets Gracex apart from other brokers in 2025? That’s the core question behind the phrase Gracexfx.com Reviews – What Sets This Broker Apart. Is it just marketing, or are there tangible differences traders can rely on? This article explores those differences — from trading costs and platforms to regulation and user experience — to determine if Gracex lives up to the title.

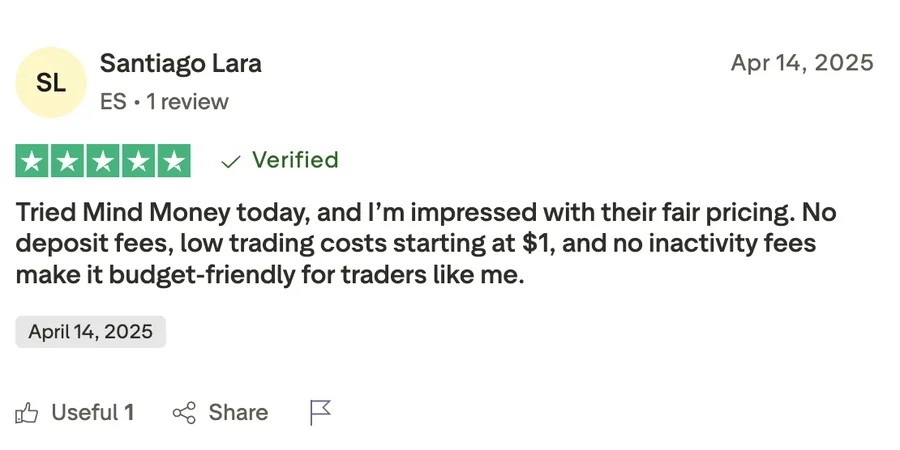

Cost Transparency: From 0.00 Pips and Zero Commission

Gracex has built its value proposition around the idea of transparency — and nothing speaks louder than its fee structure. The broker offers spreads from 0.00 pips, 0% commission on trades, and no swaps across major accounts. That means traders retain more of their profits without worrying about hidden charges or overnight costs. Combined with pure STP execution (Straight Through Processing), trades go directly to the market with no dealer interference — ensuring fast, conflict-free order fulfillment.

This level of cost-efficiency and execution precision is a cornerstone of why users cite Gracex as a broker “that frees you from outdated brokers” — where fees and delays were the norm.

Is It Regulated? Yes — Union of Comoros, License L15817/GL

Gracexfx.com operates under license L15817/GL issued by the Union of Comoros (Anjouan). It adheres to KYC/AML international compliance standards and maintains segregated client funds for capital protection. This status provides a legal safety net and demonstrates operational transparency — elements frequently mentioned in independent user reviews as trust signals.

So when reading Gracexfx.com Reviews, note how often regulation and fund safety are praised. These factors clearly support the broker’s positioning as client-focused and secure.

Account Types: From FREE to FIX — Choose What Fits

Gracex offers four tailored account types to meet different trading profiles:

- FREE: For deposits up to $500, zero commissions, great for beginners.

- ZERO: $100 monthly fee, but 0.0 spreads and all-inclusive execution.

- FIX: Fixed spreads starting from 3 points — designed for EA/backtest stability.

- CENT: $10 per lot minimums — perfect for micro-lot strategies and low-risk testing.

This versatility contributes to Gracex’s appeal across experience levels — another strong point seen in Gracexfx.com reviews from both beginners and seasoned traders.

MetaTrader 5 with Full Stack: Web, Mobile, and Desktop

Gracex runs on MetaTrader 5, the leading platform for multi-asset trading. Traders get access to:

- WebTrader (no install needed)

- Mobile apps (iOS and Android)

- Full desktop client

- Custom indicators and automated trading (Expert Advisors)

Users also gain tools for advanced charting, real-time analytics, and VPS compatibility — key components behind the broker’s automation-focused positioning. For many reviewers, these tools deliver exactly what the broker promises: freedom, flexibility, and speed.

What Assets Are Tradable?

The asset range at Gracex is surprisingly deep:

- Forex: Majors, minors, and exotic pairs

- Indices: Global and regional benchmarks

- Metals & Energy: Gold, silver, oil, gas

- Crypto: Major coins and altcoin CFDs

- CFDs: Regional equities and ETFs across Asia, Europe, Russia, and the Americas

This coverage means traders can diversify across economic zones and sectors. Many Gracexfx.com Reviews highlight this versatility as a strength, especially for portfolio-style traders or copy/PAMM users seeking consistency across assets.

Extra Services That Make a Difference

Beyond execution, Gracex offers:

- Social Copy Trading — auto-copy successful strategies

- PAMM Accounts — allocate funds to pro managers

- Bonus Offers — welcome and seasonal promotions

- Education & Analytics — market breakdowns with automation support

These features extend the broker’s value beyond simple trade placement — they build an ecosystem for learning, scaling, and replicating success. Many Gracexfx.com reviewers specifically mention these tools as dealmakers when switching from legacy platforms.

Awards Speak Volumes: Two Titles in 2024

In 2024, Gracex received:

- Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

These accolades support user testimonials about fast onboarding, helpful support teams, and platform reliability. For readers asking “Is Gracexfx.com truly different?”, this is a firm yes backed by industry recognition.

How Do Reviews Break Down?

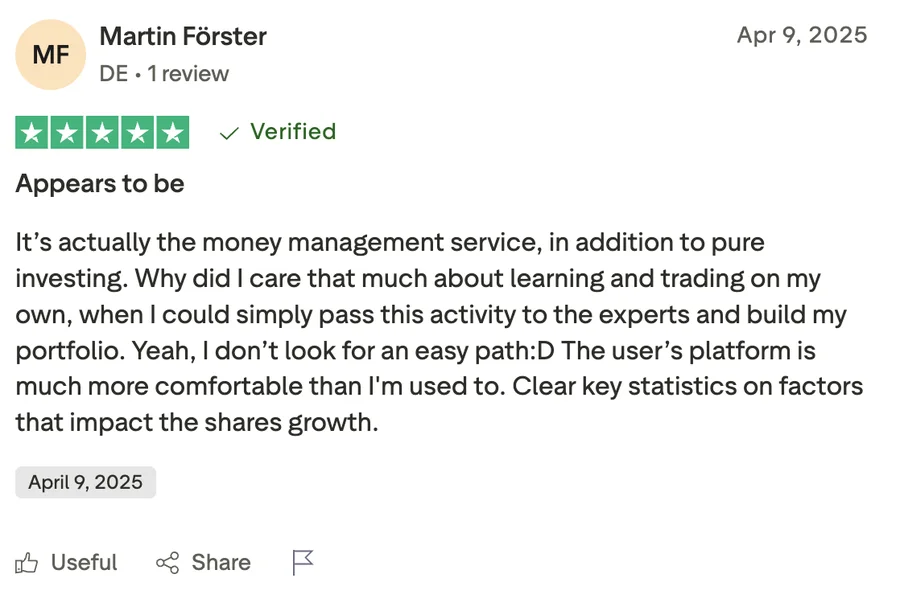

User reviews across forums and rating platforms (Trustpilot, ForexPeaceArmy, and niche broker blogs) point to these recurring strengths:

- Very low all-in cost (spread + commission + swap = near zero)

- MT5 functionality and fast execution

- Beginner-friendly tools and education

- Responsive support and easy withdrawals

Occasional weaknesses include regional limitations and verification delays — typical in brokers adhering to strong KYC. Still, feedback trends clearly support the claim: Gracexfx.com does stand apart.

Conclusion: Does Gracex Deliver on Its Promise?

So, is it true that Gracexfx.com stands apart? Yes — for traders who value cost-efficiency, automation tools, and transparent service. Its regulatory framework, platform stack, asset diversity, and client-oriented extras form a compelling case for both new and experienced users.

Checklist — What to Do Next

- ✔ Compare Gracex fees vs. your current broker

- ✔ Try a FREE account (no commission, up to $500)

- ✔ Explore the MT5 tools via demo

- ✔ Check bonus offers and PAMM options

- ✔ Verify legal registration — L15817/GL, Union of Comoros

- ✔ Read additional Gracexfx.com reviews on external platforms

In short, the question “Gracexfx.com Reviews — What Sets This Broker Apart?” has a clear answer: low-cost execution, modern tools, and real client support.