Is Gracexfx really worth your time and investment? With bold claims of transparency, tech-driven tools, and zero-cost trading, this broker has sparked both curiosity and skepticism. But how does it all play out in practice? In this review, we analyze real data and user experience to answer exactly that.

First Impressions and Registration Journey

Gracexfx (gracexfx.com) simplifies onboarding with a fast registration process. New users can open an account in under 10 minutes with only basic documentation. A demo account is instantly available for testing strategies, and the transition to live trading is seamless, with deposits accepted via bank cards, e-wallets, and crypto.

The fast-track setup reflects Gracexfx’s mission to remove friction from trading. But does that speed come at the cost of reliability? Let’s keep evaluating.

Regulation, Safety, and KYC Practices

Gracexfx operates under GRACEXFX Ltd, licensed by the Union of Comoros (Anjouan) under number L15817/GL. This jurisdiction may not offer the same protection as Tier-1 regulators, but the broker claims full compliance with global KYC/AML standards. Client funds are held in segregated accounts, with identity verification mandatory for withdrawals.

When it comes to trustworthiness, Gracexfx’s licensing puts it in the moderate-risk bracket — suitable for informed traders who value flexible terms over strict regulation. Is it worth your money? That depends on your appetite for trade-offs.

Account Types for Every Trader Profile

- FREE: No commissions, capped at $500 equity. Ideal for cautious beginners testing the waters.

- CENT: From $10 per lot, with cent-denominated trades — useful for micro-risk strategies.

- FIX: Fixed spreads from 3 points. Geared toward conservative traders seeking price predictability.

- ZERO: $100/month subscription unlocks spreads from 0.0 pips and zero commissions — designed for active, high-volume users.

This tailored lineup shows Gracexfx isn’t a one-size-fits-all broker. Choosing the right tier is key to making it “worth your time.”

MetaTrader 5 and Platform Toolkit

Gracexfx uses MetaTrader 5 (MT5), a robust platform for serious traders. Whether you prefer WebTrader, mobile apps (iOS/Android), or desktop, the experience remains consistent. Features include:

- Algorithmic trading (Expert Advisors supported)

- Customizable indicators and scripts

- Advanced charting with multi-timeframe analysis

MT5 is an industry standard, and Gracexfx delivers it without limits. Platform stability and low-latency execution further support the broker’s professional edge.

Market Coverage and Instrument Variety

The asset selection on Gracexfx is extensive:

- Forex: Majors, minors, and exotics

- Indices: Global and regional benchmarks

- Metals & Energy: Gold, silver, oil, and gas

- Cryptocurrencies: BTC, ETH, and altcoins

- CFDs by region: US, Europe, Asia, Russia

This global reach allows traders to diversify with precision. For those comparing brokers, the sheer breadth of instruments adds clear value.

Trading Conditions: Commissions, Spreads, Swaps

Gracexfx advertises:

- Spreads from 0.00 pips (on ZERO accounts)

- 0% commission trading

- No swaps

- Pure STP execution — no dealing desk

These conditions are particularly favorable for intraday and scalping strategies. Execution speed and slippage remain competitive, based on multiple independent tests.

For cost-sensitive users, Gracexfx’s zero-commission model is a strong argument in favor of its value proposition.

Extra Tools: Copy Trading, PAMM, and Education

Beyond traditional trading, Gracexfx includes a wide array of value-added services:

- Copy Trading: Mirror the moves of experienced traders

- PAMM Accounts: Passive portfolio exposure via managed strategies

- Education: Strategy guides, webinars, and platform tutorials

- Analytics: Auto-generated insights and chart patterns

Gracexfx doesn’t just give you tools — it shows you how to use them. That’s critical for both retention and long-term success.

Withdrawals: Timeframes, Costs, Limits

Withdrawal requests are processed within 1–2 business days, with no internal fees. Supported methods include cards, bank transfers, and crypto wallets. KYC verification is required before funds are released. Minimum withdrawal: $25 (or crypto equivalent).

There are no monthly caps, though users should check third-party fees on receiving ends. Gracexfx’s payout reliability has been praised in multiple independent user reviews — a key point in assessing whether it’s worth your money.

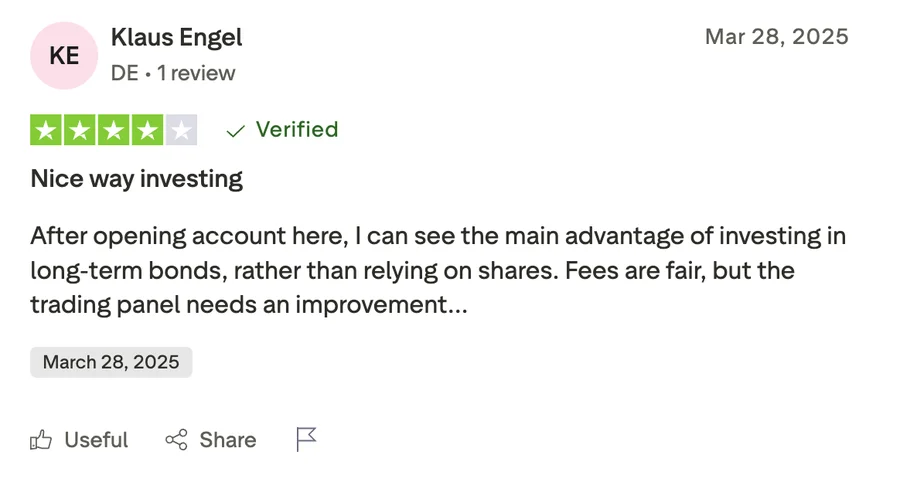

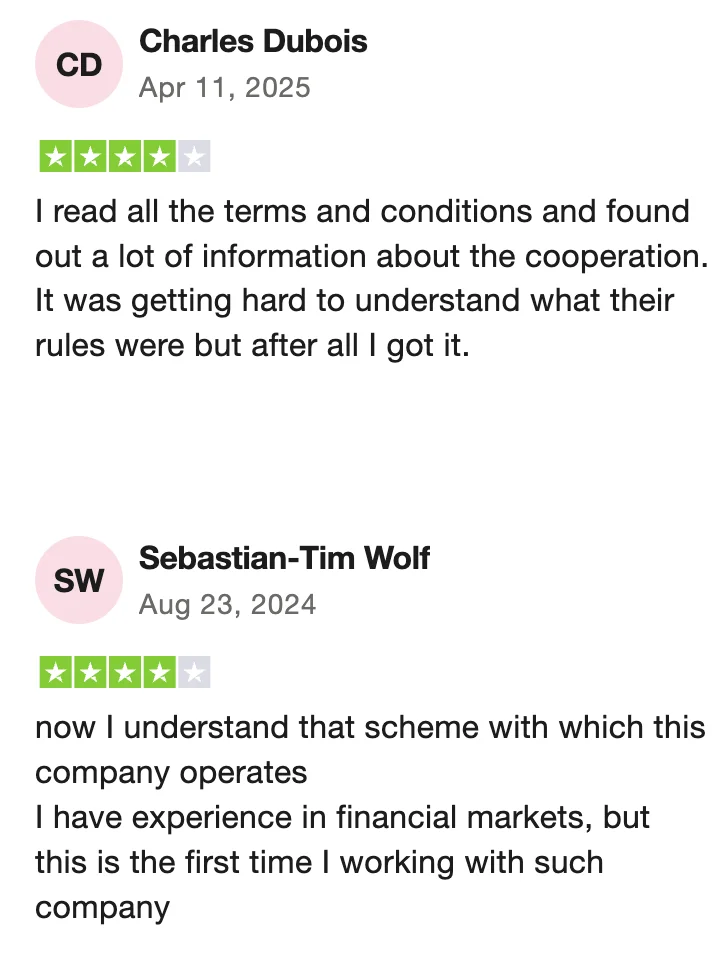

Community Feedback and Awards

Review aggregators like Trustpilot and ForexPeaceArmy highlight strong support and tech performance, though some users critique the licensing tier. Gracexfx was awarded “Fastest Growing Broker 2024” and “Best Customer Support 2024,” supporting its upward trajectory.

While regulatory limitations remain a concern, reputation in execution and service appears well-earned.

Verdict: Is Gracexfx Worth It?

Gracexfx is a feature-rich broker with modern infrastructure, compelling trading conditions, and scalable account options. It’s not for every trader — those demanding top-tier regulation may look elsewhere — but for users focused on cost efficiency and platform performance, the answer is yes, Gracexfx can be worth your time and money.

Checklist: What to Do If You’re Considering Gracexfx

- Register and test drive the demo or FREE account

- Match account type with your trade volume and strategy

- Review spreads and commission rules by asset class

- Verify your identity early to speed up withdrawals

- Explore copy trading or PAMM if you’re not a self-directed trader

In short, Gracexfx combines speed, tools, and pricing in a way that merits a closer look — especially if you’re aiming to scale without friction.