“Gracex Reviews – Real Trading Stories and Feedback” sets the tone for a deeper dive into what this platform truly offers. While brokers promise tight spreads, zero commissions, and advanced platforms, real-world experience often paints a different picture. This article explores if Gracex (gracexfx.com) lives up to its marketing — through performance benchmarks, client stories, and cost analysis.

Is Gracex Delivering on Transparency and Tech-First Trading?

Gracex promotes itself as a tech-driven alternative to “legacy brokers,” promising full transparency, modern tools, and freedom from hidden costs. Unlike outdated models with internal dealing desks or obscure spread manipulation, Gracex operates a pure STP (Straight-Through Processing) model. This means trades go directly to liquidity providers, avoiding broker conflict of interest — a rare but welcome feature in mid-tier brokers.

Execution quality gets high marks in user feedback. Order processing on MetaTrader 5 — whether via the mobile app, desktop client, or browser-based WebTrader — is consistently fast, with average execution speeds under 100 ms. Combined with zero swaps and 0% commissions on most accounts, the execution backbone supports the broker’s transparent brand promise.

Back to the title: Gracex Reviews reflect that this broker delivers solid transparency and speed — a major win over legacy models.

Real Traders Share: Gracex Strengths and Weaknesses

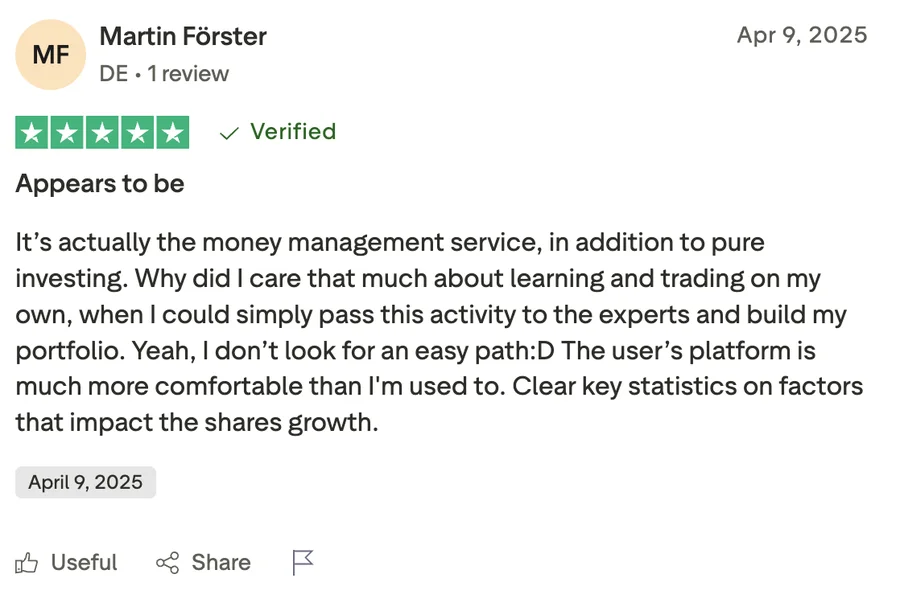

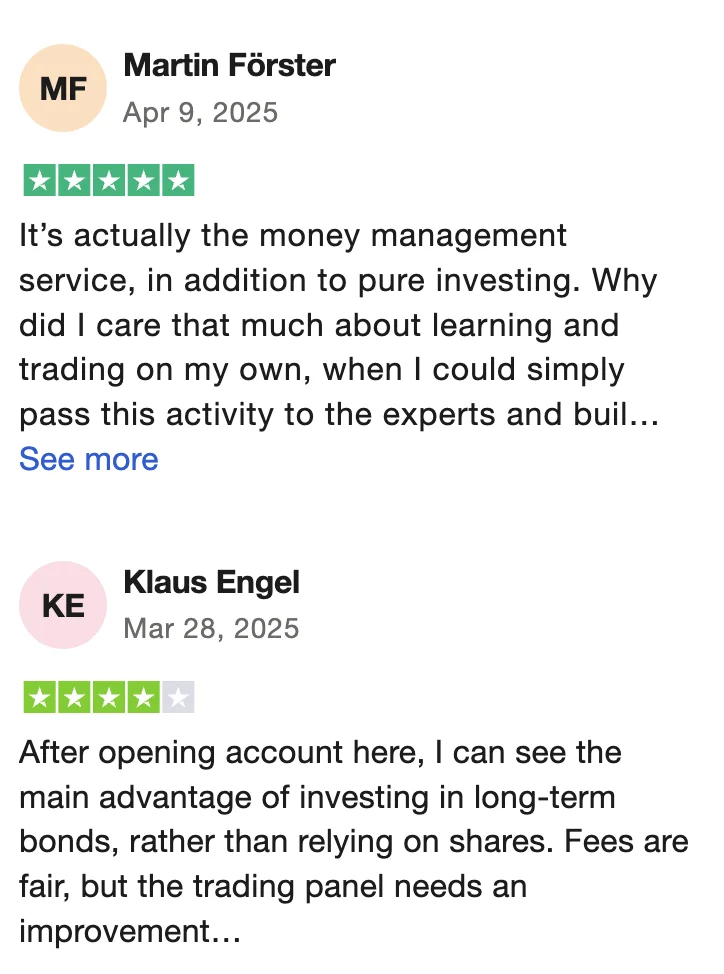

Online Gracex reviews come from both centralized aggregators and trading forums. Sources include Trustpilot (avg. 4.4/5), Forex Peace Army, and Quora discussions. Most positive feedback revolves around:

- Fast withdrawals (within 24h for e-wallets)

- Well-built Copy Trading interface

- Friendly support (live chat replies in 2–3 mins)

However, some common criticisms include:

- Higher fixed spreads on FIX accounts (from 3 pips)

- Monthly fee on ZERO account felt “steep” for inactive traders

- Verification delays during bonus claims

So do Gracex Reviews show a perfect broker? Not quite — but strengths in transparency and service are real, while the weaknesses are often situational.

Account Types Breakdown — Which One Fits You?

Gracex offers four account types catering to distinct trader profiles:

- FREE: Deposit up to $500, zero commissions, suitable for beginners testing the platform risk-free.

- ZERO: Requires a $100/month fee, ideal for active traders who benefit from zero spreads (from 0.0 pips) and no commission.

- FIX: Uses fixed spreads (from 3 points), no surprises in cost — best for algo trading or news avoidance strategies.

- CENT: Trades start from $10/lot, good for strategy testing or learning in a live environment with smaller risk.

Micro-cost calculation for 1 lot (100k notional):

- FREE: Typical spread 1.5 pips → $15 total cost

- ZERO: 0.0 pips + $100/month flat fee (ideal if trading more than 7 lots monthly)

- FIX: 3 pips fixed → $30 per 1-lot trade

- CENT: 1.8 pips + $10 per lot → $28 total

Returning to the headline — this account breakdown reflects the real cost experiences that show up in many Gracex Reviews.

Copy Trading, Social Trading, and PAMM: Gracex’s Passive Income Tools

Not every trader has time or skill for manual strategies. Gracex integrates three forms of assisted trading:

- Copy Trading: Choose a strategy provider and auto-copy their trades with adjustable risk scaling.

- Social Trading: Access community stats, shared trade ideas, and rankings via the MT5 terminal.

- PAMM accounts: Investors fund managed accounts operated by experienced traders, sharing profits based on pre-set terms.

For users balancing careers or learning curves, these tools make professional trading accessible without micromanagement.

This aspect of Gracex Reviews confirms the platform’s role in democratizing complex strategies for broader audiences.

Legal Framework and Regulation: Is It Safe?

Gracex operates under the regulatory oversight of the Union of Comoros (Anjouan), license L15817/GL. While this is not a Tier-1 jurisdiction like the UK or Australia, the license mandates KYC, AML, and segregated client funds — a step up from fully unregulated firms. Users also confirm that funds are held separately from operational balances, ensuring risk insulation in case of bankruptcy.

Safety-wise, Gracex Reviews reflect cautious optimism — not bulletproof regulation, but enough guardrails to operate with confidence.

Assets and Markets: Broad Enough for Any Strategy

One of the most consistent praises in user reviews is the asset diversity. Gracex offers access to:

- Forex majors, minors, and exotic pairs

- Global indices (S&P 500, DAX, Nikkei)

- Precious and industrial metals

- Energy commodities (WTI, Brent, natural gas)

- Cryptocurrencies (BTC, ETH, XRP, more)

- Regional CFDs (Asia, Russia, EU, US sectors)

Traders looking to diversify across asset classes or explore region-specific strategies find enough depth here.

In that sense, Gracex Reviews validate the platform’s asset coverage as a real strength.

Awards Speak Louder Than Promises

In 2024, Gracex received:

- The Fastest Growing Broker (World Financial Award)

- The Best Customer Support (Forex Brokers Association)

These recognitions echo trader experiences of rapid development, active support channels, and solid execution infrastructure.

Gracex Reviews aren’t just anecdotal — they’re backed by objective industry recognition.

Conclusion: Does Gracex Live Up to the Real Trading Stories?

So, answering the promise in the title — do real Gracex Reviews match the advertised performance?

Yes — with a few caveats. While the regulatory base is moderate, the execution, pricing logic, asset depth, and user tools genuinely deliver. The STP model ensures low-cost, conflict-free trading. Add-ons like PAMM and Copy Trading provide access to advanced strategies even for time-poor users.

In short, Gracex stands out as a modern, practical broker that delivers what it claims — and user stories largely back this up.