“Gracex Reviews – Honest Analysis for New Users” — this phrase implies clarity, reliability, and transparency. But how does Gracex actually perform in practice in 2025? Let’s unpack the platform’s real-world functionality, strengths, and trade-offs to help new users make an informed decision.

How Competitive Are Gracex’s Trading Conditions?

The headline advantage of Gracex is its ultra-low trading costs: spreads from 0.00 pips, 0% commission on trades, and no swaps. Combined with pure STP (Straight Through Processing) execution and no dealing desk, the broker avoids conflicts of interest — trades go directly to the market without interference.

For example, executing an order on EUR/USD with zero spread and no trade commission lowers the all-in cost, especially for scalpers or high-frequency traders. Swaps being removed also benefits long-term positions, making Gracex unique for swing traders.

These features validate the core question posed in the title: Gracex’s conditions are indeed favorable for cost-conscious traders.

Gracex Account Types: Purpose-Driven, Not Just Pricing

- FREE: For capital up to $500. Commission-free with market spreads. Perfect for learning the platform.

- ZERO: Flat monthly fee of $100; all trades come with zero spreads. Ideal for active traders.

- FIX: Fixed spreads from 3 points. Useful for EAs and traders who need predictability during news events.

- CENT: Trading from $10/lot with cent-size lots. Designed for micro-investing and strategy testing.

Each account serves a trading style, offering a flexible entry ramp — another proof that Gracex’s setup supports new users with diverse needs.

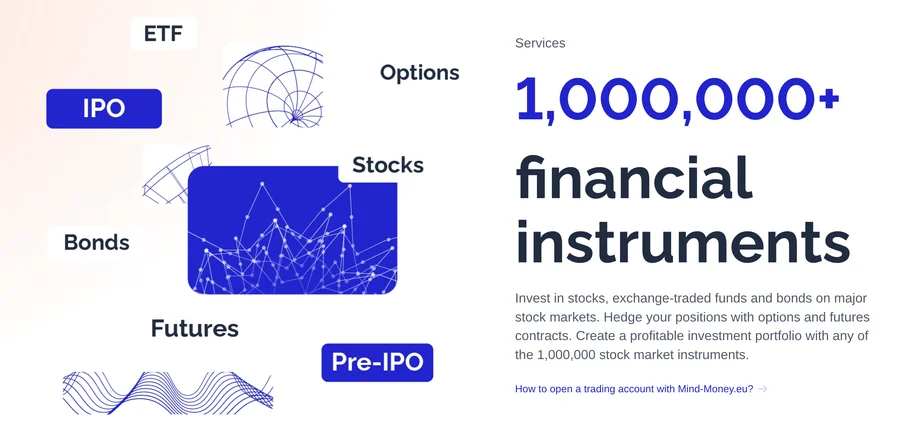

What Can You Trade on Gracex?

Asset diversity is another strong point. Gracex supports:

- Forex majors and exotics (EUR/USD, USD/ZAR, etc.)

- Global indices (S&P 500, FTSE 100, DAX)

- Metals (Gold, Silver, Platinum)

- Energy (WTI, Brent, Natural Gas)

- Cryptocurrencies (BTC, ETH, XRP, and others)

- Regional CFDs across Asia, Europe, Russia, and the US

This portfolio allows cross-market strategies and hedging — a necessity for serious retail traders. Variety makes the platform attractive for users starting in one market and scaling into others. The title’s “honest analysis” is reinforced by this practical asset range.

How Strong Is the Platform Tech Behind Gracex?

Gracex operates exclusively on MetaTrader 5 — one of the most respected trading terminals globally. MT5 at Gracex is available as:

- WebTrader: Browser-based, no installation

- Mobile apps: Full-featured iOS and Android trading

- Desktop: The most powerful version with expert advisors (EAs) and custom indicators

Users benefit from integrated automation, deep charting, advanced order types, and backtesting — critical for algorithmic traders. The inclusion of MT5 is a concrete response to our title: Gracex doesn’t cut corners in delivering professional-grade tools.

Education, Copy Trading, and Add-Ons for New Users

Gracex adds tangible value through add-ons built for beginners and intermediate traders alike:

- Copy Trading: Auto-follow successful strategies with adjustable risk parameters

- Social Trading: Insights from real-time community actions

- PAMM Accounts: Let professionals manage your capital while you retain control

- Bonuses: Conditional welcome offers

- Education & Analytics: Market updates, webinars, and trading guides included

This ecosystem is ideal for users who are not yet ready to trade independently — another strong point in favor of honest onboarding.

Is Gracex a Regulated Broker?

Yes. Gracex is regulated by the Union of Comoros (Anjouan) under license number L15817/GL. This license ensures the company maintains segregated client funds and complies with KYC/AML standards.

While not a Tier-1 license, the compliance framework still offers clarity for users, which aligns with the “honest” and “transparent” tone in the title.

How’s the Reputation? Review Sources and Feedback Patterns

Gracex has earned positive feedback from platforms like Trustpilot, BrokerChooser, and niche trading forums. Common strengths mentioned:

- Low-cost trading structure

- MT5 platform reliability

- Responsive multilingual support

Common drawbacks include:

- No Tier-1 regulation

- Some features (like PAMM) are geo-limited

The broker also won two major awards in 2024 — “Fastest Growing Broker” and “Best Customer Support” — adding weight to its credibility.

Final Verdict: Is It True Gracex Is a Good Fit for New Users?

Yes — especially for those focused on keeping trading costs low, learning on a stable platform, and exploring automation or copy trading. Gracex checks most boxes: affordability, scalability, and user support. That said, conservative investors may prefer brokers with more globally recognized licenses.

Checklist: What You Should Do Next

- ✅ Try a FREE or CENT account to get started risk-minimally

- ✅ Explore Copy Trading if you’re unsure where to begin

- ✅ Test MT5 on demo and mobile before committing capital

- ✅ Study spread vs. commission setups to choose the right account

In short, our “honest analysis” confirms that Gracex can be a strong ally for new traders entering the markets in 2025.