Is Gracex as beginner-friendly and transparent as the promises suggest? That’s what this 2025-focused review is about. We unpack the platform’s reputation, trading conditions, and real client feedback to see whether Gracex is truly a solid starting point for new and mid-level traders. Let’s see how expectations stack up against reality.

Getting Started: The Gracex Account Types Explained

Choosing the right account is essential when entering the trading world with Gracex. The broker offers four distinct options:

- FREE: Ideal for testing the waters — no commissions, max deposit $500, and access to all instruments. Great for first-time traders.

- ZERO: Built for active traders. For a flat $100/month fee, users get raw spreads from 0.0 pips and commission-free trading.

- FIX: Designed for those who prefer predictable costs — fixed spreads from 3 points, suitable for algorithmic or hedging strategies.

- CENT: A low-barrier entry ($10/lot), especially for testing strategies in a live market without high risk.

Each account aligns with a different experience level and budget. This flexibility is part of why Gracex Reviews in 2025 highlight accessibility.

Tools for Beginners and Pros: MT5 and Add-Ons

Gracex runs on MetaTrader 5 — known for its stability and flexibility. Whether via WebTrader, mobile app (iOS/Android), or PC client, users benefit from algorithmic trading support, customizable indicators, and multi-chart analysis. MT5 also integrates with Gracex’s automation features and trading signals for enhanced user experience.

On top of that, Gracex enhances usability with:

- Copy Trading: Automatically mirror expert traders’ strategies in real time.

- Social Trading: Observe and follow top community performers and trending strategies.

- PAMM accounts: Delegate capital to experienced managers with transparent performance metrics.

- Educational Center: Video tutorials, trading guides, and analytics segmented by skill level.

- Bonuses and Loyalty Offers: Available depending on account tier and region.

This toolkit shows Gracex is more than just a platform — it’s a trading ecosystem. It aligns well with the title theme: how to start with minimal friction in 2025.

What Can You Trade at Gracex?

The broker supports a broad spectrum of global markets:

- Forex: All major, minor, and exotic pairs.

- Indices: US500, GER40, UK100, and many more.

- Metals and Energy: Gold, silver, oil — with tight spreads and STP execution.

- Crypto Assets: BTC, ETH, and altcoins — but regulated based on jurisdiction.

- Regional CFDs: Sector-specific and country-based contracts from Asia, EU, MENA, LATAM.

Each instrument comes with STP execution and tight pricing. Spreads start from 0.00 pips, with no trade commissions and no swaps. All trades are routed via pure Straight Through Processing — no dealing desk, no conflict of interest.

These conditions address common concerns found in 2025 Gracex Reviews: execution reliability and pricing transparency.

Execution Quality: Does Tier‑1 Liquidity Matter?

Yes — and here’s why. Gracex uses Tier‑1 liquidity providers (DBS, HSBC, Citi, UBS, Bank of China), minimizing slippage and improving execution speed. For example, scalpers and high-frequency traders notice tighter spreads and faster fills even during volatile events like NFP releases or FOMC minutes.

This makes a huge difference, especially for ZERO and FIX accounts. According to many Gracex Reviews in 2025, fast order execution remains a recurring strength.

Licensing, Legal Protection, and Client Safety

Gracex operates under license L15817/GL, issued by the Union of Comoros (Anjouan). While not Tier‑1, the license requires:

- Segregation of client funds in secured financial institutions

- Full compliance with KYC and AML policies

- Ongoing audit and oversight

It’s not the same as FCA or ASIC regulation, but it’s significantly more structured than offshore setups with no oversight. Users should always be aware of jurisdictional implications before depositing.

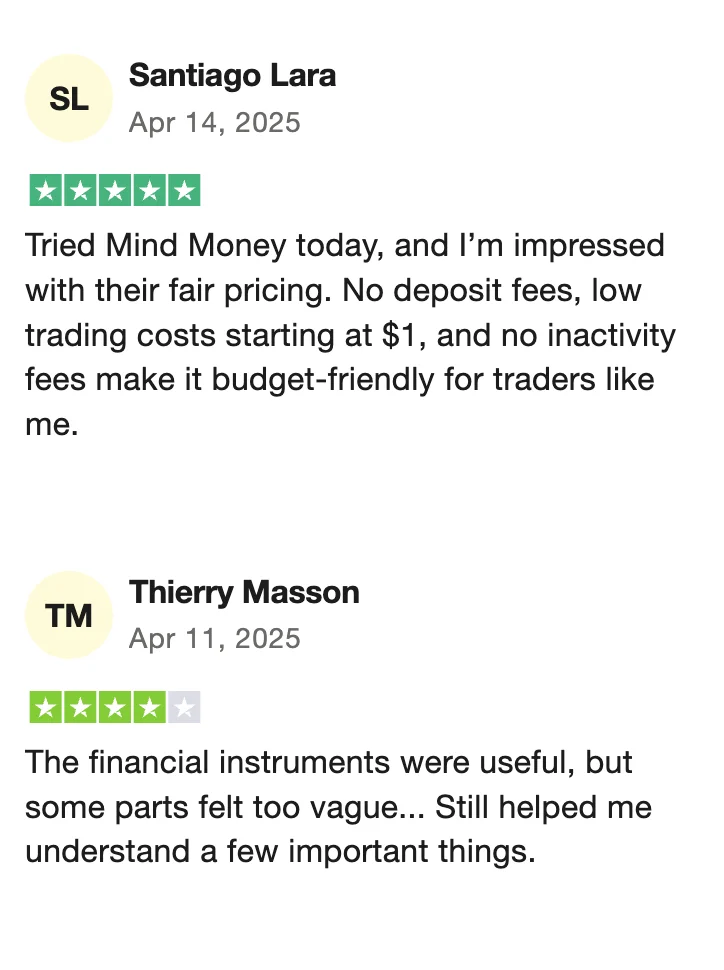

Reputation: What Real Gracex Reviews Say in 2025

User feedback is spread across platforms like Trustpilot, Forex Peace Army, and social communities like Reddit’s r/Forex or Telegram groups.

What users like:

- Low-cost execution (especially on ZERO and FREE accounts)

- Stable platform uptime and fast withdrawals

- Responsive multi-language support team

Common complaints:

- Geo-restrictions (not available in the US or Russia)

- Bonuses have certain withdrawal requirements

- PAMM manager availability varies by region

Combined with industry recognition — like The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association) — the reputation is overall positive, especially among retail traders entering the market.

So, Is Gracex a Good Starting Point in 2025?

Yes — if your expectations match your experience level. For new traders, FREE and CENT accounts offer risk-controlled access. For active traders, ZERO and FIX unlock performance-focused conditions. Add to that MT5 tools, automation, copy/social options, and education — and it’s clear the platform is tailored for a confident start.

Just make sure to consider the legal structure and platform availability in your region.

Final Verdict: Gracex delivers on its promise as a next-gen broker for 2025. While it’s not without limits, its combination of tools, pricing, and user support makes it one of the most accessible platforms for starting (and scaling) your trading journey today.